- Duration / Course length: Upto 22 Hours Start now

- Accredited by: CPDiAP

- Certificates:

- Course delivery: This course is delivered in video format

Course details

Learning accounting for small businesses can be a very rewarding experience. Accounting is practical and can be put to good use, benefiting small businesses often run without any accounting knowledge or standard practices. Small business accounting involves basics of the accounting cycle plus inventory control, if needed. Accounting doesn't need to be complicated or full of steps, it can be simple and effective for the small firm.This Diploma course covers the types of information that need to be included and what systems should be used to record them. The course explains methods for improving and forecasting cash flow and budgets within the business and outlines how to respond to purchase and sales invoices. There is also a module explaining the importance of good credit control, including how to successfully speak to and deal with late-paying customers.

This course gives you a skillset that includes the day-to-day financial operations tasks carried out by small- to medium-sized businesses.

Our online programme is well designed that you feel same as you are in the classroom. This course is comprised of professionally narrated e-Learning modules, interactive quizzes, tests and exams. All delivered through a system that you will have access to 24 hours a day, 7 days a week in 365 days (12 months). Effective support service, and study materials including step by step guided tutorial videos build your confidence to study well and guide you to secure your qualification.

This online training course is comprehensive and designed to cover the following key topics are listed under the curriculum. This course has been designed for 30 guided learning hours.

COURSE CURRICULUM:

- Introduction to Accounting

- Financial Statements

- Assets and Liabilities

- Accounting Transactions

- Inventory and Cost Methods

- Stakeholders and Equity

- Managerial Accounting

- Cost Accounting

- Costs and Expenses

- Budgetary Control

- Analysis and Decision Making

- Module Book- Accounting for Small Business

- Bookkeeping Training Manual

You will have 12 Months access to your online study platform from the date you purchased the course. The course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time.

Method of Assessment:

At the end of the course learners will also take an online multiple choice questions assessment test. This online multiple choice questions test is marked automatically so you will receive an instant grade and know whether you have passed the course.

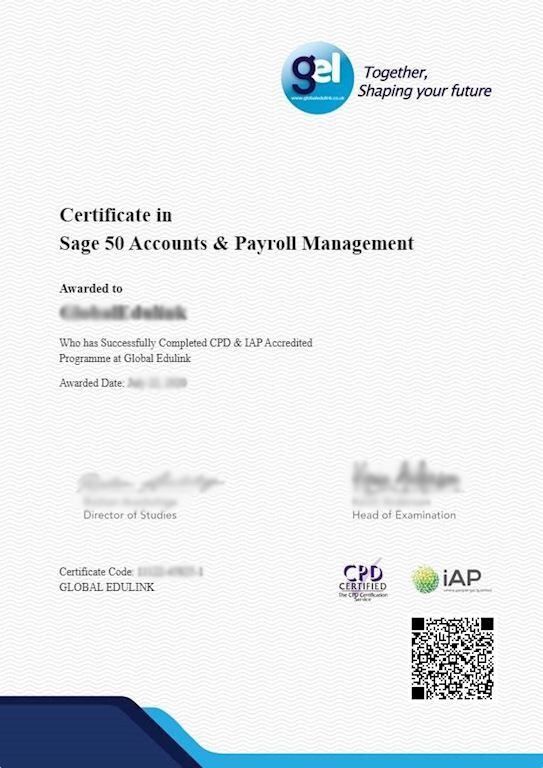

Certification:

Successful candidates will be awarded certificate for “Diploma in Small Business Accounting”.

Benefits you will gain:

By enrolling in to this course, you’ll get:

- High quality e-learning study materials and mock exams.

- Tutorials/materials from the industry leading experts.

- Includes step-by-step tutorial videos and an effective, professional support service.

- 24/7 Access to the Learning Portal.

- Benefit of applying NUS extra Discount Card.

- Recognised Accredited Qualification.

- Access Course Content on Mobile, Tablet or Desktop.

- Study in a user friendly, advanced online learning platform.

- Excellent customer service and administrative support.

Ultima actualização em 10 December, 2024

Eligibility / Requirements

- This course is available to all students, of all academic backgrounds. Having basic knowledge and skills in Accounting would be an advantage for this course.

- Learners should be ages 16 or over to undertake the qualification.

- Basic understanding of English language, literacy, numeracy and ICT are required to attend this course.

.jpg)

.jpg)

.jpg)