- Duration / Course length: Upto 25 Hours Start now

- Accredited by: CPDiAP

- Certificates:

- Course delivery: This course is delivered in video format

Course details

Would you like a career with great earning potential and the chance for progression?Accountancy is an excellent path to choose, as accountants are in high demand at the moment and receive frequent promotions once they have 1 or 2 years of experience. Whether you hope to become an accountant or need to learn to do accounts for your own business, this course bundle is the perfect guide.

This Accounting Certification Course Bundle is a combination of the courses of:

- Accounting Essentials

- Accounting for Business

- Business Accounting

- Small Business Accounting

Studying with Global Edulink has many advantages. The course material is delivered straight to you, and can be adapted to fit in with your lifestyle. It is created by experts within the industry, meaning you are receiving accurate information, which is up-to-date and easy to understand. This course is comprised of professionally narrated e-Learning modules, interactive quizzes, tests and exams. All delivered through a system that you will have access to 24 hours a day, 7 days a week for 365 days (12 months). An effective support service and study materials will build your confidence to study efficiently and guide you to secure your qualification.

Course Objectives:

The main aim of this course is to provide students with a full understanding of the role and responsibilities of an Accountant or Bookkeeper, and the ability to carry out the daily tasks of an Accountant or Bookkeeper to a high standard.

This online training course is comprehensive and designed to cover the topics listed under the curriculum.

COURSE CURRICULUM

---------------ACCOUNTING ESSENTIALS---------------

1. BASICS ACCOUNTING AND DEBITS & CREDITS

- Accounting Basics

- Definition of Accounts, Debits & Credits

-----------------ACCOUNTING FOR BUSINESS-----------------

01. COURSE INTRODUCTION

02. DEFINITIONS OF ACCOUNTING

03. OVERVIEW OF FINANCIAL ACCOUNTING

04. LEARNING MANAGERIAL ACCOUNTING

05. UNDERSTANDING INCOME TAXES

06. CONCLUSION

----------------BUSINESS ACCOUNTING---------------

01

- Introduction to Bookkeeping

- Defining a Business

- Ethics and Accounting Principles

- Accounting Equation & Transactions

- Financial Statements

- The Accounting Equation and Transactions

- Transactions – Journalizing

- Posting Entries and The Trial Balance

- Finding Errors Using Horizontal Analysis

- The Purpose of the Adjusting Process

- Adjusting Entries

- Vertical Analysis

- Preparing a Worksheet

- The Income Statement

- Financial Statements- Definitions

- Temporary vs. Permanent Accounts

- Accounting Cycle

- Financial Year

- Spreadsheet Exercise

- Introduction to Accounting

- Financial Statements

- Assets and Liabilities

- Inventory and Cost Methods

- Stakeholders and Equity

- Managerial Accounting

- Cost Accounting

- Costs and Expenses

- Budgetary Control

- Analysis and Decision Making

- Module Book- Accounting for Small Business

At the end of each course learners will take an online multiple-choice questions assessment test. This online multiple-choice question test is marked automatically so you will receive an instant grade and know whether you have passed the course.

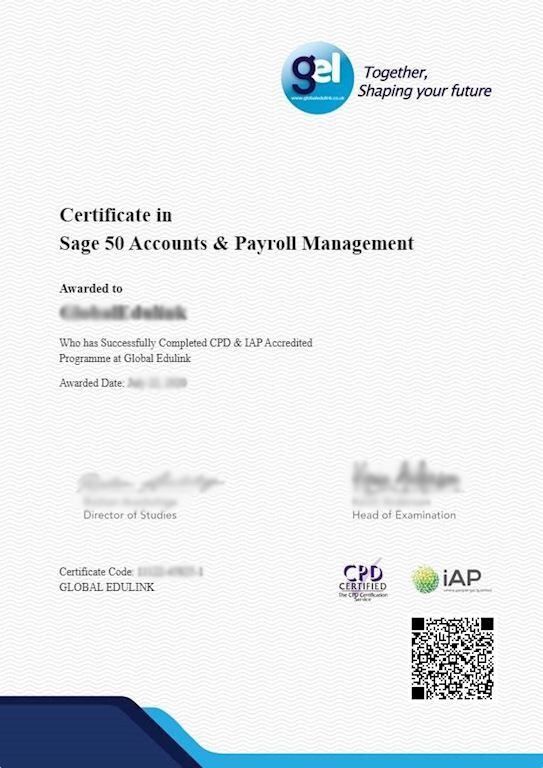

Certification:

Upon successful completion of this course, you will be awarded an Accounting Certification for each course separately.

Ultima actualização em 10 December, 2024

Eligibility / Requirements

Learners must be age 16 or over and should have a good grasp of basic English, literacy, numeracy, and ICT.

.jpg)

.jpg)

.jpg)