- Duration / Course length: Há 20 Horas Start now

- Accredited by: CPDiAP

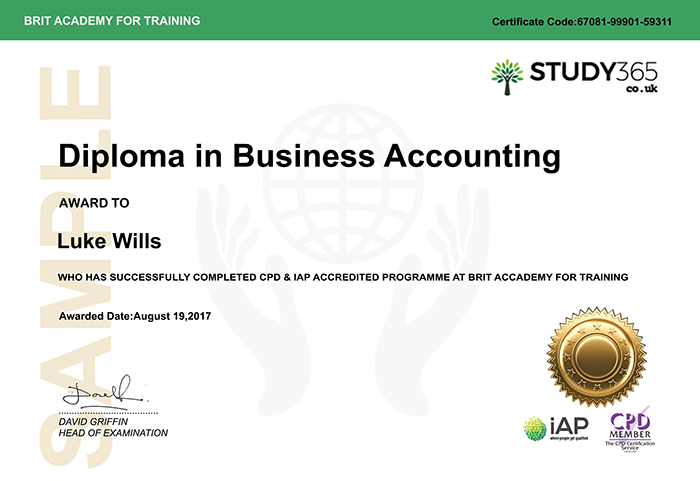

- Certificates:

- Course delivery: This course is delivered in video format

Course details

Accounting has become an essential part of business life, and the knowledge and skills that you will learn in your studies will give you a broader and more experienced view of business life.

For a business, nothing is more important than its finances. This Business Accounting Diploma course will provide you with a good understanding of business accounts, essential knowledge if you run a small business; are considering setting one up or need to learn more about company accounts for your current or future role.

Whether you are starting your own business or supplementing your understanding of accounting, this diploma course will help you understand accounting basics and give you meaningful financial tools to understand business.

Understanding the four basic financial statements, Income Statement, Balance Sheet, Statement of Retained Earnings, and Statement of Cash Flows, is a key to evaluating companies for your investment decisions. But this business course goes beyond just understanding these financial statements. Business Accounting Basics takes you through the building blocks and accounting cycles that create each statement. In addition, this course will give you the basic tools to project profitability and break your costs down to help analyse any company.

It’s not easy deciding on a career path with so much uncertainty in the market place. One thing is for sure: with this qualification on your CV, you can offer financial expertise to countless businesses crying out for your online training course is comprehensive and designed to cover the following key topics are listed under the curriculum. This course has been designed for 30 guided learning hours.

COURSE CURRICULUM

BOOKKEEPING AND PAYROLL MANAGEMENT

- Introduction to Bookkeeping and Payroll

- Transactions

- Internal Controls and Control Concepts

- Working with Ledgers

- Reconciliation

- Correcting Entries

- Sales Tax, Rules and Filing

- Budgeting & Strategic Plan

- Types of Budgets

- Merchandising Income Statement

- Sales and Purchase Discounts

- Petty Cash

- Cash Controls – The Bank Reconciliation

- The Payroll Process

- Payroll Process – Earnings Record

- The Partnership & Corporations

- Accounts Receivable and Bad Debts

- Preparing Interim Statements

- Year End – Inventory

ADDITIONAL STUDY MATERIALS

REFERENCE BOOKS

BUSINESS ACCOUNTING

- Introduction to Bookkeeping

- Defining a Business

- Ethics and Accounting Principles

- Accounting Equation & Transactions

- Financial Statements

- The Accounting Equation and Transactions

- Transactions – Journalizing

- Posting Entries and The Trial Balance

- Finding Errors Using Horizontal Analysis

- The Purpose of the Adjusting Process

- Adjusting Entries

- Vertical Analysis

- Preparing a Worksheet

- The Income Statement

- Financial Statements- Definitions

- Temporary vs. Permanent Accounts

- Accounting Cycle

- Financial Year

- Spreadsheet Exercise

Course Duration:

You will have 12 Months access to your online study platform from the date you purchased the course. The course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time.

Method of Assessment:

At the end of the course learners will also take an online multiple choice questions assessment test. This online multiple choice questions test is marked automatically so you will receive an instant grade and know whether you have passed the course.

Certification:

Successful candidates will be awarded Diploma for “Business Accounting”.

Ultima actualização em 27 February, 2024

Eligibility / Requirements

Learners must be age 16 or over and should have a basic understanding of the English Language, numeracy, literacy, and ICT.