- Duration / Course length: Upto 22 Hours Start now

- Accredited by: CPDiAP

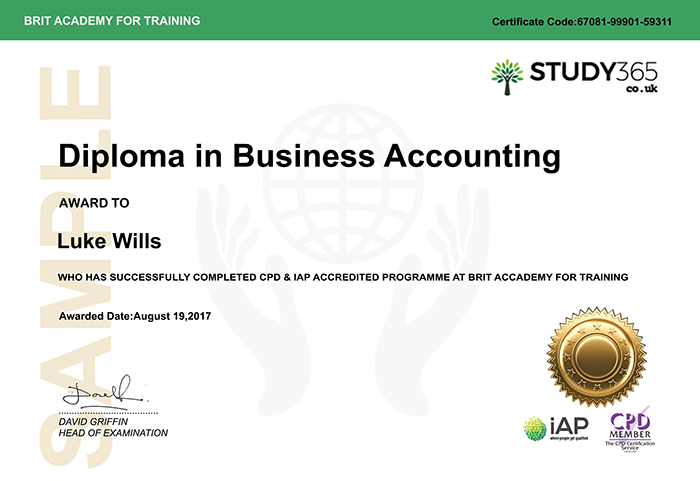

- Certificates:

- Course delivery: This course is delivered in video format

Course details

Did you know that every business, by law, has to keep books? That’s why there is a demand for qualified bookkeepers. This online Bookkeeping and Payroll Management training course provides individuals, small business owners and management with the information they need to create an effective and reliable bookkeeping system. This course allows you to enhance your Accounting and Bookkeeping skills and prove to employers and recruiters that you’re able to provide office Accounting and Bookkeeping duties to the highest standards.A bookkeeper keeps business financial records and performs basic and essential accounting tasks. QuickBooks is one of the best accounting software packages around with both online and desktop versions. In this online course you will learn how to set up QuickBooks Online for your clients, how to Create a company file, Navigate QuickBooks, create a chart of accounts, Add the accounts you need to your chart of accounts, set up customers, vendors, and the products you sell in QuickBooks, Create and send invoices and sales receipts, Enter and pay bills, Make journal entries, Track expenses and income, Manage your Account Receivable and Accounts Payable, Connect to your bank through QuickBooks, Create budgets and run reports and much more

Additionally, you will learn Introduction to bookkeeping and accounting, explains the fundamental rules of double-entry bookkeeping and how they are used to produce the balance sheet and the profit and loss account.

This Bookkeeping and Payroll Management training course is comprehensive and is designed to cover the following key areas. This course has been designed for 30 guided learning hours and each unit carries 10 guided learning hours:

1. Accounting and Bookkeeping Essentails

- Introduction to Basic Accounting

- Financial Accounting

- Managerial Accounting

- Income Taxes

- Introduction and Review the Financial Statements

- Bookkeeping Process

- Transaction and Accounting Equation

- The General Ledger

- Basic Terminology

- Accounting Methods

- Keeping Track of Your Business

- Understanding the Balance Sheet

- Financial Statements

- End of Period Procedures

- Budgets & Financial Reports

- Introduction QuickBooks and Setup

- Tools of QuickBooks

- Preferences

- Security & Users

- Estimates

- Sales and Orders

- Receiving Money

- Bounced Checks and Specific Tracking

- Receiving and Depositing

- Credit Cards and Bank Accounts

- Payroll & Transactions

- Accounts and Reports

- Integrating

- Data Type

- Creating and Setting Up Your Point of Sale Company File

- Setting up Sales Tax

- Rewards Program

- Sales

- Tracking Sales Commissions

- Receiving from a Purchase Order

- Multi-Store

At the end of the course learners will also take an online multiple choice questions assessment test. This online multiple choice questions test is marked automatically so you will receive an instant grade and know whether you have passed the course.

Certification:

Successful candidates will be awarded certificates for “Bookkeeping and Payroll Management Training”.

Why Choose Us?

- Our courses represent outstanding value for money

- High quality e-learning study materials and mock exams.

- Each course is designed by industry experts, using an innovative interactive learning approach.

- Includes step-by-step guided videos tutorials.

- Benefit of applying NUS extra Discount Card.

- 24/7 Access to the Online Learning Portal.

- Anytime & Anywhere Learning.

- Recognised Accredited Qualification.

- Access Course Content on Mobile, Tablet or Desktop.

- Study in a user friendly, advanced online learning platform.

- Excellent customer service and administrative support.

Ultima actualização em 13 March, 2024

Eligibility / Requirements

- Learners must be age 17 or over and should have a basic understanding of the English Language, numeracy, literacy, and ICT.