- Duration / Course length: Upto 28 Hours Start now

- Accredited by: CPDiAP

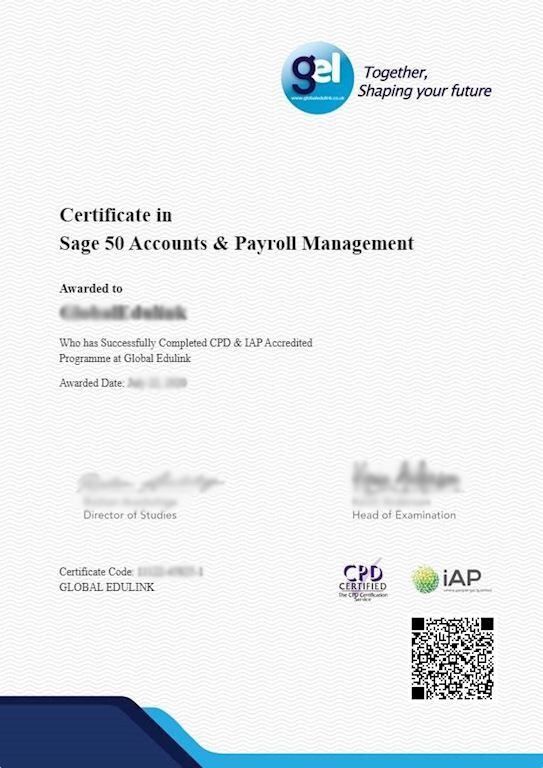

- Certificates:

- Course delivery: This course is delivered in video format

Course details

Did you know that every business, by law, has to keep books? That’s why there is a demand for qualified bookkeepers. And when you study with Global Edulink, you’ll find it easier to get a job because you’ll have a widely recognised qualification on your CV.This online Bookkeeping and Payroll Management training course provides individuals, small business owners and management with the information they need to create an effective and reliable bookkeeping system. Give your career a boost with the well-recognised Global Edulink’s Bookkeeping and Payroll Management qualification.

Global Edulink, as a leading training courses provider in the UK, this course allows you to enhance your Accounting and Bookkeeping skills and prove to employers and recruiters that you’re able to provide office Accounting and Bookkeeping duties to the highest standards.

A bookkeeper keeps business financial records and performs basic and essential accounting tasks. QuickBooks is one of the best accounting software packages around with both online and desktop versions. In this online course you will learn how to set up QuickBooks Online for your clients, how to Create a company file, Navigate QuickBooks, create a chart of accounts, Add the accounts you need to your chart of accounts, set up customers, vendors, and the products you sell in QuickBooks, Create and send invoices and sales receipts, Enter and pay bills, Make journal entries, Track expenses and income, Manage your Account Receivable and Accounts Payable, Connect to your bank through QuickBooks, Create budgets and run reports and much more

Additionally, you will learn Introduction to bookkeeping and accounting, explains the fundamental rules of double-entry bookkeeping and how they are used to produce the balance sheet and the profit and loss account.

Our online programme is well designed that make you feel same as you are in the classroom. Efficient Mentor support service, step by step guided videos, reading and study materials, online study platform, and forum build your confidence to study well and guide you to get good results and it secures your qualification.

This Bookkeeping and Payroll Management training course is comprehensive and is designed to cover the following key areas. This course has been designed for 30 guided learning hours and each unit carries 10 guided learning hours:

UNIT 01: Accounting and Bookkeeping Essentials

- Introduction to Basic Accounting

- Financial Accounting

- Managerial Accounting

- Income Taxes

- Introduction and Review the Financial Statements

- Bookkeeping Process

- Transaction and Accounting Equation

- The General Ledger

- Accounting Methods

- Keeping Track of Your Business Accounts Payable (Accounts Receivable, The Journal, The General Ledger, Cash Management)

- Understanding the Balance Sheet (The Accounting Equation, Double-Entry Accounting, Types of Assets, Types of Liabilities, Equity)

- Other Financial Statements (Income Statement, Cash Flow Statement, Capital Statement, Budget vs. Actual)

- Payroll Accounting / Terminology (Gross Wages, Net Wages, Employee Tax Withholding's, Employer Tax Expenses, Salary Deferrals, Employee Payroll, Employee Benefits, Tracking Accrued Leave, Government Payroll Returns/Reports)

- End of Period Procedures (Depreciating Your Assets, Reconciling Cash, Reconciling Investments, Working with the Trial Balance, Bad Debt)

- Financial Planning, Budgeting and Control (Reasons for Budgeting, creating a Budget, Comparing Budget to Actual Expenses)

- Auditing (What is an Audit? When and Why Would You Audit? Internal, External)

- Introduction to QuickBooks and Setup

- Tools of QuickBooks

- Preference

- Security and Users

- Estimates

- Sales and Orders

- Receiving Money

- Bounced Checks and Specific Tracking

- Receiving and Depositing

- Credit Cards and Bank Accounts

- Payroll and Transactions

- Accounts and Reports

- Integrating with Ms Word

- Data Type and Conclusion

- Creating and Setting up your point of sales

- Installing the System

- Setting up Sales Tax

- Rewards Program

- Sales

- Collecting Sales Tax

- Adding Shipping Information

- Tracking Sales Commissions

- Purchasing Merchandise

- Receiving from a Purchase Order

- Managing Inventory

- Multi-Store

At the end of the course learners will also take an online multiple choice questions assessment test. This online multiple choice questions test is marked automatically so you will receive an instant grade and know whether you have passed the course.

Certification

Successful candidates will be awarded certificates for “Bookkeeping and Payroll Management Training”.

Benefits you will gain:

By enrolling in to this course, you’ll get:

- High quality e-learning study materials and mock exams.

- Tutorials/materials from the industry leading experts.

- Includes step-by-step tutorial videos and an effective, professional support service.

- 24/7 Access to the Learning Portal.

- Benefit of applying NUS extra Discount Card.

- Recognised Accredited Qualification.

- Access Course Content on Mobile, Tablet or Desktop.

- Study in a user friendly, advanced online learning platform.

- Excellent customer service and administrative support.

Ultima actualização em 10 December, 2024

Eligibility / Requirements

- This course is available to all students, of all academic backgrounds.

- Learners should be ages 17 or over to undertake the qualification.

- Basic understanding of English language, literacy, numeracy and ICT are required to attend this course.

.jpg)

.jpg)

.jpg)