- Duration / Course length: Upto 12 Hours Start now

- Accredited by: CPDiAP

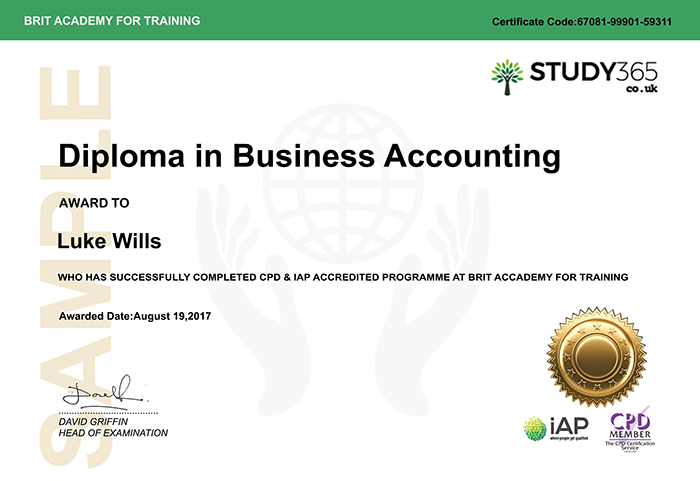

- Certificates:

- Course delivery: This course is delivered in video format

Course details

Did you know that every business, by law, has to keep books? Also, it is a legal requirement to issue sales invoices and keep accounts records for a minimum of six years, so it is essential that businesses have an effective and manageable bookkeeping system in place. That’s why there is a demand for qualified bookkeepers. And when you study with Study365, you’ll find it easier to get a job because you’ll have a widely recognised qualification on your CV.Bookkeeping is the activity of keeping accurate records of all movements of money or of things with value that take place in a particular business or organisation. The only qualities a would-be bookkeeper needs are some common sense, a logical mind, the ability to write neatly and the ability to do simple arithmetic accurately – and nowadays most arithmetic is done on a calculator.

Managing and processing a business’s payroll is an important task, and it’s vital that those handling the payroll have a full understanding and knowledge of the processes involved.

This course is designed to teach you the basic to advance rules of book-keeping and payroll management in easy stages so that you gradually build up your knowledge and confidence and eventually achieve complete mastery of the subject at this level. More importantly, you will be able to handle your own accounting records, or those of an employer, in a practical and professional manner.

This online training course is comprehensive and designed to cover the following key topics are listed under the curriculum. This course has been designed for 30 guided learning hours.

COURSE CURRICULUM

MODULE 01

- Introduction to Bookkeeping and Payroll

- Transactions

- Internal Controls and Control Concepts

- Working with Ledgers

- Reconciliation

- Correcting Entries

- Sales Tax, Rules and Filing

- Budgeting & Strategic Plan

- Types of Budgets

- Merchandising Income Statement

- Sales and Purchase Discounts

- Petty Cash

- Cash Controls – The Bank Reconciliation

- The Payroll Process

- Payroll Process – Earnings Record

- The Partnership & Corporations

- Accounts Receivable and Bad Debts

- Preparing Interim Statements

- Year End – Inventory

- Module Handouts- Bookkeeping and Payroll Management

- Additional Study Materials- Business Accounting

You will have 12 Months access to your online study platform from the date you purchased the course. The course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time.

Method of Assessment:

At the end of the course learners will also take an online multiple choice questions assessment test. This online multiple choice questions test is marked automatically so you will receive an instant grade and know whether you have passed the course.

Certification:

Successful candidates will be awarded Diploma for “Bookkeeping and Payroll Management”.

Ultima actualização em 26 February, 2024

Eligibility / Requirements

- Learners must be age 16 or over and should have a basic understanding of the English Language, numeracy, literacy, and ICT.