- Duration / Course length: Upto 3 Months Start now

- Accredited by: UKRLPACBS

- Certificates:

- Course delivery: This course is delivered in presentation format

Course details

ETF Advisor DiplomaDuration: 3 months

Assessment: One comprehensive practical assignment

Become a knowledgeable and effective ETF Advisor with this internationally recognized diploma that equips you with detailed understanding and practical skills to guide investment decisions in the rapidly growing ETF market. This fully online, flexible program covers fundamental to advanced ETF concepts, enabling you to advise clients and manage ETF portfolios confidently.

Course Modules and Key Learnings:

- What ETFs Are

Understand Exchange-Traded Funds (ETFs), their structure, and how they function in capital markets. - How ETFs Are Created and Priced

Learn about the ETF creation and redemption mechanisms, arbitrage processes, and pricing dynamics. - ETFs Compared to Index Mutual Funds

Explore similarities and differences including liquidity, cost structures, tax efficiency, and trading flexibility. - Advantages and Disadvantages of ETFs

Analyze benefits such as diversification and transparency, along with considerations like tracking error and liquidity risks. - Tax and Operational Efficiency of ETFs

Study the tax implications and operational aspects that contribute to ETFs' efficiency relative to other investment vehicles. - International Diversification of ETFs

Examine ways ETFs provide access to global markets, emerging economies, and various asset classes. - ETF Basket and Regulation

Understand ETF portfolio composition, regulatory frameworks, and compliance issues affecting ETF markets. - Comparing Fees by Structure

Learn to evaluate ETF expense ratios, fee structures, and how costs impact investment returns. - Actively Managed ETFs

Distinguish between passive and actively managed ETFs, and understand their strategic roles. - Calculating the Net Asset Value

Master the methodology for computing NAV and its influence on ETF pricing. - Currency ETFs

Explore ETF products focused on currency exposure and hedging strategies. - Additional Topics

Dive deeper into trading strategies, ETF market trends, risk management, and emerging ETF products.

Your understanding and application of ETF concepts will be assessed through one practical assignment, which applies your learning to real-world advisory scenarios. Students may begin the assignment immediately and complete the diploma flexibly upon submission.

Updated on 31 July, 2025

Job roles this course is suitable for:

ETF Advisor , ETF Capital Markets Specialist , ETF SpecialistAbout City of London College of Economics

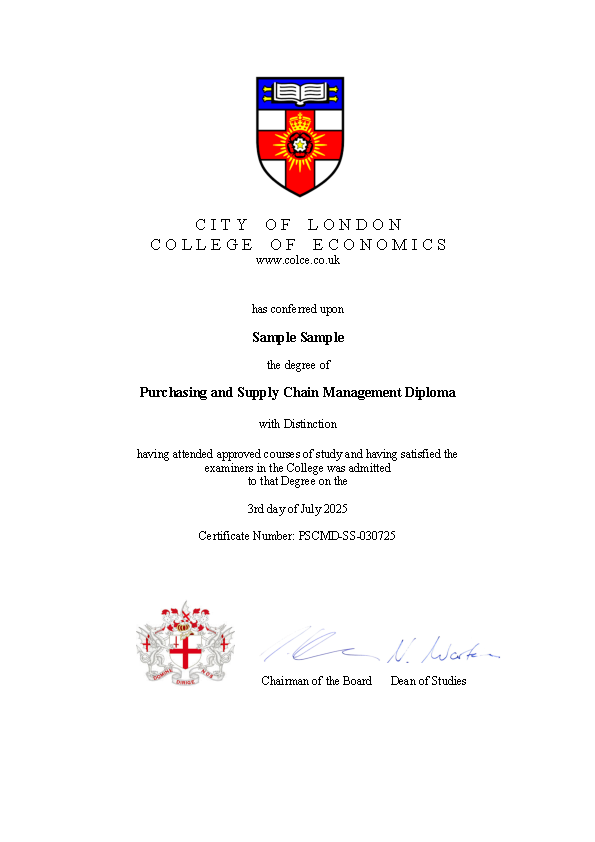

City of London College of Economics (COLCE) is a recognized educational institution offering affordable, accredited online courses for vocational and academic growth. Our programs are self-paced for your convenience and designed with a practical focus, meeting high-quality and compliance standards (DSG, ISO 27001). We support learners worldwide in enhancing their career opportunities through comprehensive knowledge in economics, management, and related fields. COLCE is listed in the UK Government Register of Verified Learning Providers (Reference Number: 10089366) and accredited by the British Government, UKRLP, as well as the Association of Colleges and Business Schools (Certificate Serial Number: ACBS/COLCE/011525NF).