- مدة الدورة التدريبية: 20 ساعة إبدأ الآن

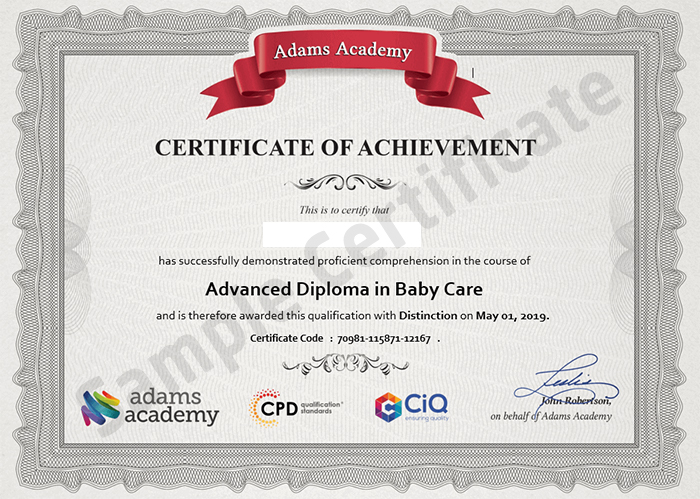

- معتمدة من قبل: CiQCPD Qualification Standards

- الشهادة:

- طريقة تقديم الدورة: عبر عرض الفيديو

تفاصيل الدورة

A country’s economic growth depends upon the foundation laid by the small and medium sized businesses. That is why they need room in order to grow, flourish and support big businesses. Sometimes, with so many branches of a company needs to be taken care of, it can often become nettlesome for the owners to run the business smoothly. To be honest, it’s nothing to worry about. With the help of this Sage 50 Payroll Beginners Training course you will learn to use the Sage 50 payroll software with excellent expertise.This course covers disparate topics and with each chapter, it is clearly mentioned the objectives of your convenience. The Sage 50 softwares are great for managing administrative tasks and as a result allows the user to focus on more cardinal matters. As the name implies, this course focuses on payroll and you can expect to learn payroll basics, management of employees, updating records and reports, and much more.

Having accurate and timely data is critical for payroll and accounts to run smoothly, which is why you should consider getting this course right now, as it will help you do just.

Why Should You Choose Sage 50 Payroll Beginners Training

Internationally recognised accredited qualification

1 year accessibility to the course

Free e-Certificate

Instant certificate validation facility

Properly curated course with comprehensive syllabus

Full-time tutor support on working days (Monday – Friday)

Efficient exam system, assessment and instant results

Access to the course content on mobile, tablet or desktop from anywhere anytime

Eligible for **NUS Extra** card which gives you 1000’s of discounts from biggest companies.

Course Curriculum:

Module 1: Payroll Basics – Setting up payroll, tax codes, month end, reports, keeping records, licence limitations and links to an accounts program

Module 2: Company Settings – Details, bank & coinage, absence, analysis, tax funding, statutory funding, HMRC payments, documents

Module 3: Legislation Settings – Legislation setting dialog box, PAYE, NI bands & rates, SSP, SMP/SAP/SPP/ShPP, car details, student, AEO rates, minimum wage, childcare, automatic enrolment

Module 4: Pension Scheme Basics – Pensions schemes dialog box, setting up pension scheme, pensions regulator website and the sage 50 payroll pensions module

Module 5: Pay Elements – Pay elements settings dialog box, managing payment and deduction types, loans, net payments, salary sacrifice

Module 6: The Processing Date – Changing the processing date

Module 7: Adding Existing Employees – Using quick employee, adding multiple employees, changing their status, updating year-to-date values

Module 8: Adding New Employees –Adding new employees in a variety of ways

Module 9: Payroll Processing Basics – Payroll process view, change processing dates

Module 10: Entering Payments – Entering payment window, checking and editing payments

Module 11: Pre-Update Reports – Employer costs report, payslips, BACS payments reports, figures for accounts

Module 12: Updating Records – Updating records, period end P32 report

Module 13: e-Submissions Basics – e-submissions settings, EAS, FPS, EPS

Module 14: Process Payroll (November) – Entering payments, pre-update reports, updating records, P32 reports, full payment submission

Module 15: Employee Records and Reports – Using employee record window, tabs and to find employee and their reports

Module 16: Editing Employee Records – Editing different records for employees, creating new factored pay elements, applying pay elements to employees

Module 17: Process Payroll (December) – Processing the payroll, entering payments, pre-update reports, updating records, P32 report and Full payment submission

Module 18: Resetting Payments – Introduction to reset payments wizard

Module 19: Quick SSP – Processing the payroll with SSP, entering payments, pre-update reports, updating records, P32 report and full payment submission

Module 20: An Employee Leaves – Entering payments, updating records, lever wizard, P32 report, full payment submission, rejoining employees

Module 21: Final Payroll Run – Entering payments, pre-update reports, updating records, P32 report, full payment submissions

Module 22: Reports and Historical Data – Reports window, employee, company, legislation and historical reports, historical data settings, printing historical payslips and history report by employee

Module 23: Year-End Procedures – Year end tasks, payroll year end wizard, post year-end tasks تحديث بتاريخ 25 February, 2022

نبذة عن معهد Adams Academy

About us

Adams Academy is best known for offering award body accredited online courses that are available for anyone who wishes to acquire a certification and take their professional life to the next level. As an online learning site, we are aware of the fact that there are a lot of people out there who considers themselves to be a curious learner but the courses that they are interested in are not available in the area. So, we have decided to give them a chance to learn in a convenient way – in their own convenient place and time.

Our Mission

To make learning more accessible to learning enthusiasts, regardless of where they are residing in the world. To offer different courses of different levels for the students to choose from. To position our company as a leader in the industry of online learning.

Our Vision

Maintain the good credibility and reputation that we have built as online courses provider