- مدة الدورة التدريبية: 13 ساعة إبدأ الآن

- معتمدة من قبل: CPD Qualification Standards

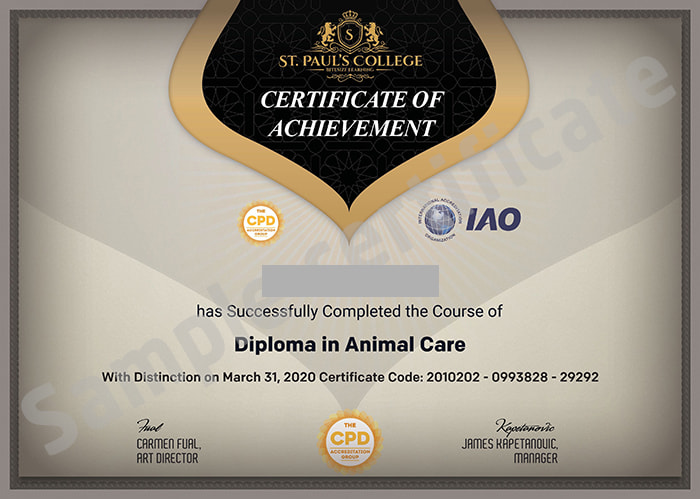

- الشهادة:

- طريقة تقديم الدورة: عبر عرض الفيديو

تفاصيل الدورة

Learn to protect the financial system against money laundering with the Anti-Money Laundering Course course.

Money laundering is the criminal business used to disguise the true origin and ownership of illegal cash. The course is designed to familiarize you with the process of money laundering so that you can secure your company from the criminal business.

Throughout the course, you will explore the important issues of anti-money laundering and understand the necessity of raising awareness about the types of crimes. Firstly, you will understand the meaning of money laundering and know the methods of doing it. After that, the course discusses the Anti-Money Laundering Legislation and regulatory framework in the UK. You will also explore your responsibilities for anti-money laundering. Then, the course illustrates the Risk-Based Approach (RBA) with examples. The techniques of applying Customer Due Diligence and Legislation and the strategies of keeping records will be covered in the course. Next, the course deals with the methods of identifying and reporting suspicious activities. Finally, the course guides you on how to train your employee in the situation.

By the end of the course, you will be able to confident enough to commit your company or business firm from protecting the fiancé from money laundering.

Course Curriculum:

Anti-Money Laundering Online Course

- What is Money Laundering?

- More Definitions of Money Laundering

- How Money Laundering Works

- The Economic and Social Consequences of Money Laundering

- Methods of Money Laundering

- Payable Through Accounts

- Concentration Accounts

- Structuring

- Bank Complicity

- Non-Bank Financial Institutions

- Insurance Companies

- What is Financial Inclusion?

- Anti Money Laundering

- Record Keeping

- High Currency Amount Transaction Reporting

- Suspicious Transaction Reporting

- Fraud Prevention for Money Transfers

- Terrorism Financing Prevention

- Designation of a Compliance Officer

- Upon conclusion of the course, there’s an online multiple-choice quiz assessment, which will determine whether you have passed the course. The test is marked immediately and results are published instantly (60% pass mark).

Certification:

- Certificates can be obtained at an additional cost of £9.99 for PDF, £16.99 for Printed Hardcopy format, and £24.99 for Both PDF and Hardcopy Certificates.

المتطلبات

This course is available to all learners, of all academic backgrounds. A good understanding of the English language, numeracy and ICT are required to attend this course.

وظائف مناسبة لهذه الدورة

Junior Compliance Analyst , AML Compliance Analyst , AML/KYC Analyst , AML Associateنبذة عن معهد St. Paul's College

With a rapidly growing international presence, we are a U.K. based provider of online courses. Not only are these courses aimed at the broad spectrum of individuals looking to acquire a qualification in order to boost their skills and expertise, but also at businesses. In addition to helping countless individuals, we also offer a range of services to many different types of organisation. Our courses help people and businesses become the best they can be, adding value and driving professional development forward.

We are aware that many individuals and companies are unable to access the right courses or training packages to meet their needs. As an online learning platform, we wish to offer the best possible solution to this problem, providing helpful and informative courses to individuals and comprehensive training packages to businesses.