- Duration / Course length: Upto 30 Hours Start now

- Accredited by: CPDiAP

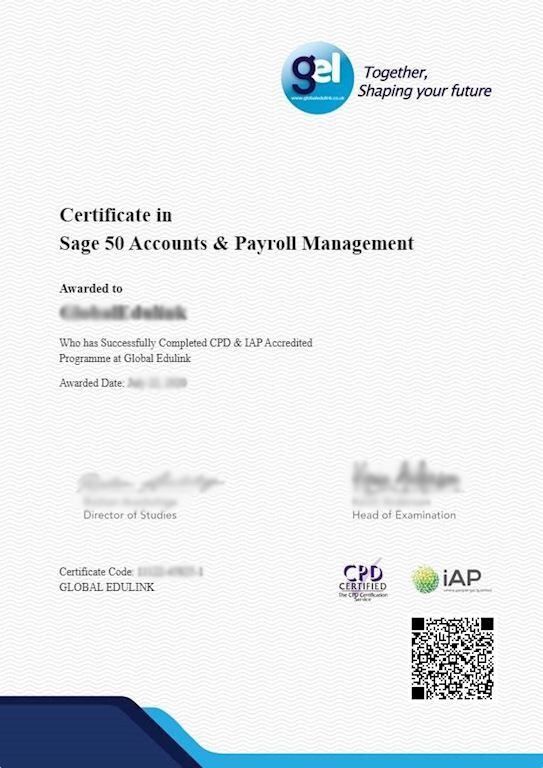

- Certificates:

- Course delivery: This course is delivered in video format

Course details

If you are looking for a career in Accountancy, or Finance or wish to develop the necessary skills to start-up your own business then this course will be a great start.Accountancy courses open up career opportunities not just in the accountancy companies but in a huge range of public and private sector organisations that have their own finance offices. A career in Accounts can be very rewarding, and also a very secure choice, as every business needs to keep and maintain financial records. Whether you’re looking to become an Accounts Assistant, Payroll Clerk, or simply need to add financial record management knowledge to your skillset, this online training courses will suit you.

From this advanced accounting course is designed to support your journey towards your dream career. This online course work with your current level of knowledge and experience to prepare you thoroughly for success. The course is structured to enable both those new to accountancy and experienced professionals to gain valuable learning experience.

This online course looks in-depth at the transactions, processes and controls used to record typical transactions in a business. This course teaches you management and financial accounting theories and techniques in depth including bookkeeping techniques. This Advance Accounting and Bookkeeping courses cover everything you will need to have a successful career in Accounting and Bookkeeping. With this qualification on your CV you will be able to gain a role such as Bookkeeper, Accounts Assistant or Finance Clerk.

This online training course is comprehensive and is designed to cover the following key topics are listed under the curriculum. This course has been designed for 40 guided learning hours.

COURSE CURRICULUM

UNIT 01. ADVANCED ACCOUNTING

- Type of Business Ownership

- Accounting Concepts

- Accounting Journals and Ledgers

- Formulas & Equations

- Financial Statements

- Analysing of Financial Statements

- Inventory Management

- Accounting for Depreciation

- Accounting for Compensation, Taxes & Liabilities

- Closing and Adjusting Entries

- Corporate Accounts

- Introduction to Accounting

- What are Financial Statements in Accounting

- The Accounting Cycles

- Preparing Financial Statements

- Control in Accounting

- Inventory Management in Accounting

- Accounts Receivable

- Operating Cycle in Accounting

- Asset Management Section 02

- Liabilities in Accounting

- Equity in Accounting- Section 2

- Cash flow Statement Patterns

- Analysing Financial Statements in Accounting

Bookkeeping Training Manual

UNIT 04. ADDITIONAL STUDY MATERIALS

Additional Study Materials- Advance Accounting

Course Duration:

You will have 12 Months access to your online study platform from the date you purchased the course. The course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time.

Method of Assessment:

At the end of the course learners will also take an online multiple choice questions assessment test. This online multiple choice questions test is marked automatically so you will receive an instant grade and know whether you have passed the course.

Certification:

Successful candidates will be awarded certificate for “Diploma in Advance Accounting and Bookkeeping”.

Benefits you will gain:

By enrolling in to this course, you’ll get:

- High quality e-learning study materials and mock exams.

- Tutorials/materials from the industry leading experts.

- Includes step-by-step tutorial videos and an effective, professional support service.

- 24/7 Access to the Learning Portal.

- Benefit of applying NUS extra Discount Card.

- Recognised Accredited Qualification.

- Access Course Content on Mobile, Tablet or Desktop.

- Study in a user friendly, advanced online learning platform.

- Excellent customer service and administrative support.

Ultima actualização em 09 April, 2024

Eligibility / Requirements

- This course is available to all students, of all academic backgrounds. Having basic knowledge and skills of Finance and Accounting would be an advantage for this course.

- Learners should be ages 16 or over to undertake the qualification.

- Basic understanding of English language, literacy, numeracy and ICT are required to attend this course.

.jpg)

.jpg)

.jpg)