- Duration / Course length: Upto 3 Months Start now

- Accredited by: UKRLPACBS

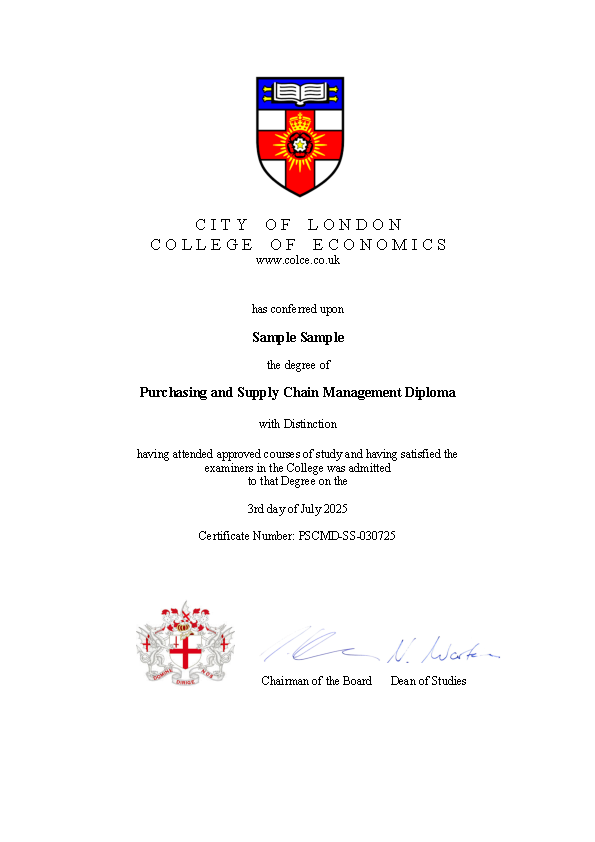

- Certificates:

- Course delivery: This course is delivered in presentation format

Course details

Commodity Trader DiplomaDuration: 3 months

Assessment: One comprehensive practical assignment

Become proficient in commodity trading and develop the skills to succeed in global markets with this internationally recognized diploma. Designed for aspiring commodity traders, this fully online and flexible program covers essential knowledge of commodities markets, trading mechanisms, risk management, and investment strategies.

Course Modules and Key Learnings:

- Commodities: Just the Facts

Understand the fundamental nature of commodities, including their categories such as energy, metals, and agricultural products. - The Futures Markets

Learn how futures contracts operate and their role in commodity trading and price risk management. - The Equity Markets and Managed Funds

Explore how equities and managed funds participate in commodity investments. - Commodity Sectors: Energy, Metals, Agricultural Products

Gain detailed insights into specific commodity sectors, their market dynamics, and trading peculiarities. - Risks in Commodity Trading

Identify and manage various types of risks including market, credit, operational, and geopolitical risks. - Investment Vehicles: ETFs and Commodity Indexes

Understand how exchange-traded funds (ETFs) and commodity indexes are used to gain commodity exposure. - Choosing the Right Trading Account

Know how to select and set up accounts suitable for commodity trading. - Placing Orders and Trading Strategies

Master practical aspects of order placement, execution, and commonly used trading strategies. - Top Ten Ways to Invest in Commodities

Learn diverse methods for commodity investment tailored to different risk and return objectives. - Top Ten Market Indicators to Monitor

Identify key market indicators and data sources essential for informed trading decisions. - Resources and Tools You Can’t Do Without

Access and utilize important trading platforms, news sources, and analytical tools. - And More

Additional topics covering market psychology, seasonal trends, and emerging market opportunities.

You will demonstrate your ability to apply course knowledge through one practical assignment that simulates real trading scenarios. Students can start the assignment from day one and complete the program flexibly upon submission.

Updated on 31 July, 2025

Eligibility / Requirements

There are no requirements to be fulfilled.

About City of London College of Economics

City of London College of Economics (COLCE) is a recognized educational institution offering affordable, accredited online courses for vocational and academic growth. Our programs are self-paced for your convenience and designed with a practical focus, meeting high-quality and compliance standards (DSG, ISO 27001). We support learners worldwide in enhancing their career opportunities through comprehensive knowledge in economics, management, and related fields. COLCE is listed in the UK Government Register of Verified Learning Providers (Reference Number: 10089366) and accredited by the British Government, UKRLP, as well as the Association of Colleges and Business Schools (Certificate Serial Number: ACBS/COLCE/011525NF).