- Duration / Course length: Upto 6 Months Start now

- Accredited by: UKRLPACBS

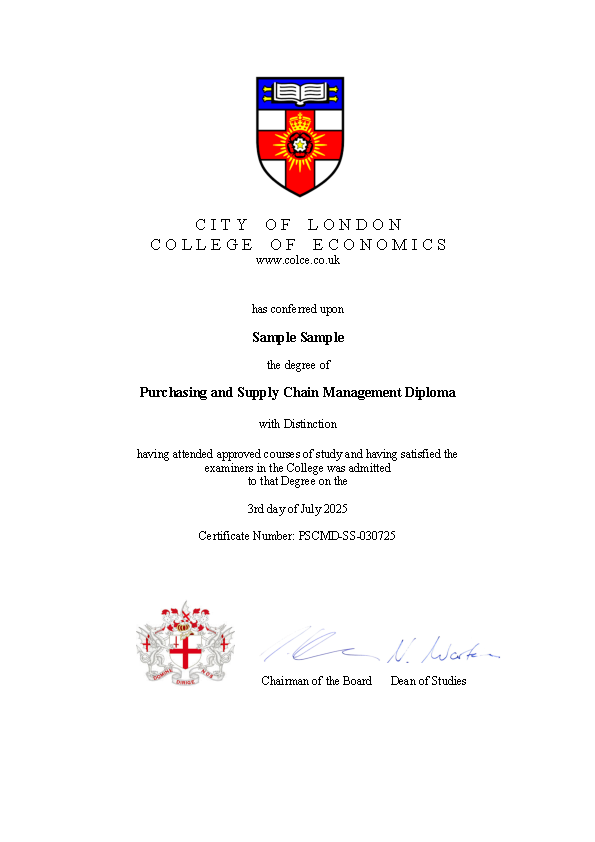

- Certificates:

- Course delivery: This course is delivered in presentation format

Course details

Finance Manager Diploma – Master’s LevelDuration: 6 months

Assessment: One comprehensive assignment

Accelerate your career with this prestigious, internationally recognized diploma designed to prepare you as a competent and confident finance manager. This fully online and flexible program enables you to master essential financial management skills critical for high-demand roles in diverse organizations.

Course Modules and Key Learnings:

- Overview of Financial Management

Gain foundational knowledge of financial management principles and functions. - Financial Statements, Cash Flow, and Taxes

Learn to prepare, analyze, and interpret financial statements and manage taxation issues. - Analysis of Financial Statements

Develop skills to assess financial health and performance through detailed statement analysis. - Financial Planning and Forecasting

Acquire techniques to project future financial outcomes and support strategic decisions. - The Financial Environment: Markets, Institutions, and Interest Rates

Understand the broader financial ecosystem impacting corporate finance. - Risk and Rates of Return

Analyze risk factors and calculate appropriate returns for financial decision-making. - Time Value of Money

Master concepts such as discounting and compounding crucial for investment appraisal. - Bonds and Their Valuation

Learn valuation methods for fixed-income securities and their role in portfolios. - Stocks and Their Valuation

Explore equity valuation models and market behavior of stocks. - Cost of Capital

Understand how to estimate the cost of financing and its impact on investment decisions. - Basics of Capital Budgeting

Evaluate investment projects using financial appraisal methods. - Cash Flow Estimation and Risk Analysis

Estimate project cash flows accurately and incorporate risk factors into analysis. - Capital Structure and Leverage

Study optimal financing mix and leverage effects on firm value and risk. - Distributions to Shareholders: Dividends and Share Repurchases

Analyze shareholder return policies and their financial implications. - Working Capital Management

Manage short-term assets and liabilities to ensure operational liquidity. - Multinational Financial Management

Address complexities of financial decisions in global business environments. - Self-Test Questions and Model Solutions

Reinforce learning with practical problems and detailed answers. - 50 Models for Strategic Thinking

Apply strategic financial models to real-world decision-making.

Designed for practical application, assessment consists of one final assignment that integrates module knowledge in real-world finance management scenarios. Start your assignment from day one and complete the course upon submission, enabling flexible pacing according to your readiness.

Updated on 31 July, 2025

Eligibility / Requirements

Prior knowledge would be a great advantage

About City of London College of Economics

City of London College of Economics (COLCE) is a recognized educational institution offering affordable, accredited online courses for vocational and academic growth. Our programs are self-paced for your convenience and designed with a practical focus, meeting high-quality and compliance standards (DSG, ISO 27001). We support learners worldwide in enhancing their career opportunities through comprehensive knowledge in economics, management, and related fields. COLCE is listed in the UK Government Register of Verified Learning Providers (Reference Number: 10089366) and accredited by the British Government, UKRLP, as well as the Association of Colleges and Business Schools (Certificate Serial Number: ACBS/COLCE/011525NF).