- Duration / Course length: Upto 3 Months Start now

- Accredited by: UKRLPACBS

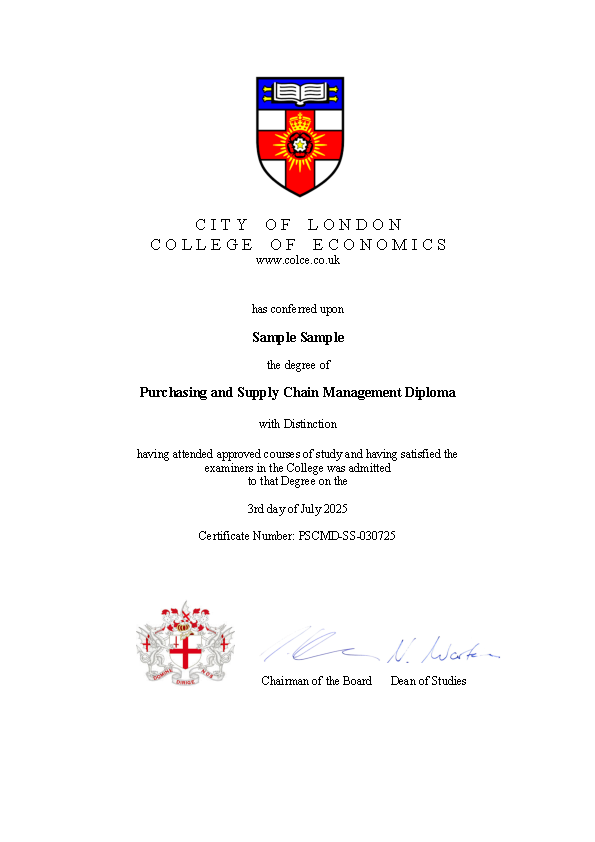

- Certificates:

- Course delivery: This course is delivered in presentation format

Course details

Diploma in Behavioural Finance and Wealth ManagementDuration: 3 months

Assessment: One comprehensive practical assignment

Enhance your expertise in investment portfolio construction and wealth management by mastering the principles of behavioral finance that explain investor biases and decision-making errors. This prestigious, internationally recognized diploma equips you with the knowledge and skills to build optimal portfolios and deliver smarter financial advice by incorporating psychological insights into asset allocation strategies.

Course Modules and Key Learnings:

; Introduction to Behavioral Finance

Understand the foundations and history of behavioral finance and how it challenges traditional finance theories.

; Investor Biases and Their Impact

Explore a wide range of cognitive and emotional biases such as:

· Overconfidence, Representativeness, Anchoring and Adjustment

· Cognitive Dissonance, Availability, Self-Attribution

· Illusion of Control, Conservatism, Ambiguity Aversion

· Endowment, Self-Control, Optimism, Mental Accounting

· Confirmation, Hindsight, Loss Aversion, Recency

· Regret Aversion, Framing, Status Quo Bias

; Incorporating Investor Behavior in Asset Allocation

Learn how to adjust portfolio construction to account for behavioral tendencies and mitigate their negative effects.

; Case Studies

Analyze real-world examples illustrating the impact of behavioral finance on investment decisions.

; Gender, Personality Type, and Investor Behavior

Understand how individual differences influence financial decisions and portfolio preferences.

; Investor Personality Types

Discover different investor profiles and tailor financial advice accordingly.

; Neuroeconomics: The Next Frontier

Gain insights into emerging research combining neuroscience and economics to better explain investor behavior.

Assessment:

Your mastery of the course content will be assessed through one practical assignment designed to apply behavioral finance concepts in real-world wealth management scenarios. You may begin your assignment immediately and complete the course flexibly at your own pace.

Updated on 31 July, 2025

Eligibility / Requirements

There are no requirements to be fulfilled

Job roles this course is suitable for:

Portfolio Manager , Portfolio Analyst , Discretionary Portfolio AdvisorAbout City of London College of Economics

City of London College of Economics (COLCE) is a recognized educational institution offering affordable, accredited online courses for vocational and academic growth. Our programs are self-paced for your convenience and designed with a practical focus, meeting high-quality and compliance standards (DSG, ISO 27001). We support learners worldwide in enhancing their career opportunities through comprehensive knowledge in economics, management, and related fields. COLCE is listed in the UK Government Register of Verified Learning Providers (Reference Number: 10089366) and accredited by the British Government, UKRLP, as well as the Association of Colleges and Business Schools (Certificate Serial Number: ACBS/COLCE/011525NF).