- Duration / Course length: 500 Hours Start now

- Accredited by: ABC Awards

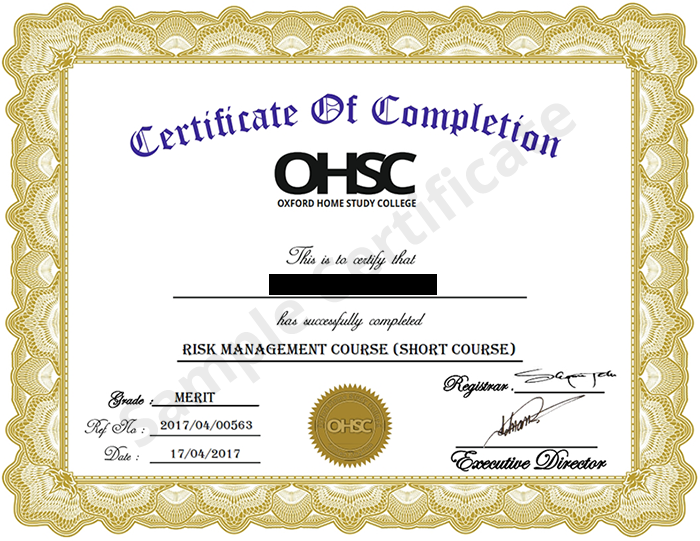

- Certificates:

- Course delivery: This course is delivered in presentation format

Course details

Forensic AccountingCertificate of achievement Advanced Diploma in Forensic Accounting QLS Level 7. Additional CPD Accredited Certificate with 150 CPD points available with no extra study.

Endorsed Forensic Accounting Course Certificate of Achievement. This premium-quality Forensic Accounting Course has been designed to provide newcomers with an essential overview of the profession, along with the primary duties and responsibilities of the forensic accountant. Learn how fraud has a detrimental impact on modern society, along with how to effectively detect and prevent various types of fraud.

Study fraud case investigation, use of financial and non-financial evidence, risk factors which may affect the likelihood of fraud and so much more besides. Study Forensic Accounting Course at home for a fully-endorsed certificate from a recognised awarding body!

Forensic Accounting

Qualified forensic accountants enjoy the freedom to work almost anywhere in the world under their own terms. The skills and talents of capable forensic accountants have never been in greater demand, as businesses worldwide attempt to cope with the ever-intensifying threat of financial fraud. An entirely more dynamic and investigative profession than conventional accountancy, forensic accountancy is ideal for anyone with a flair for numbers and an inquisitive nature. If ready to get started, sign up for our exclusive Level 7 Forensic Accountancy Course today!

On this Forensic Accounting Course you will learn techniques for identifying, detecting and preventing fraud activities. The Forensic Accounting Course is an ideal way to take a start in this highly demanding and lucrative field. No previous knowledge in accounting or forensic accounting is essential to join the course.

Forensic Accounting - Course Syllabus:

This Forensic Accounting Course covers the following modules:

Unit 1 - Forensic and Investigative accounting - An Overview

This unit covers the following topics:

Introduction to Forensic Accounting

Brief History of Fraud and the Antifraud Profession

What Is Fraud?

Types of Investigation

Conducting an Investigation

Forensic Accountants, Fraud Auditors and Financial Auditors

Required Knowledge, Skills, and Abilities for Forensic Accountants

Plus more

Unit 2 - Economic trends and Crime

This unit covers the following topics:

Crime and Economy

Cost Reality

Financial Crimes

Mail-Order Procedures

Keys to Effective Fraud Investigation

Plus more

Unit 3 - Spotting a typical fraudster

This unit covers the following topics:

Psychology of Fraudsters

High-Level and Low-Level Thieves

Victims of Fraud

Plus more

Unit 4 - Effective Techniques for fraud detection

This unit covers the following topics:

Fraud Detection: Overview

Laying a Foundation for Detection

Assessing the Risk of Fraud

Fraud Risk Factors

Identifying and Evaluating Risk Factors

Information Gathering

Analytic Procedures

Analytic Techniques

Financial Statement Fraud: Detection Techniques

Specific Detection Methods

Billing Schemes

Payroll Schemes

Revenue Recognition Detection Techniques

Plus more

Unit 5 - Procedures for Investigation

This unit covers the following topics:

The Investigative Process

Plus more

Unit 6 - The Basics of Collecting Evidences

This unit covers the following topics:

Gathering Evidence

Evidence

Evidence Created by the Forensic Accounting Investigator

What Kind of Evidence should be Gathered?

Document Collection

Sources of Documents

Document Organization

Plus more

Unit 7 - Gaining & Assessing Non-Financial Evidence

This unit covers the following topics:

Obtaining and Evaluating Non-Financial Evidence

Interviews

Statement Analysis

Plus more

Unit 8 - Forensic Interviewing Techniques and Processes

This unit covers the following topics:

Interviewing Techniques

The Interview

Planning the Interview

The Interview Process

Plus more

Unit 9 - conducting a fraud risk assessment Successfully

This unit covers the following topics:

Fraud Risk Assessment

Risk Assessment Factors

Risk Assessment Best Practices

Plus more

Unit 10 - Strategies for Fraud Prevention

This unit covers the following topics:

Fraud Prevention

Plus more

Unit 11 - Cyber crime and its prevention

This unit covers the following topics:

What is Computer Forensics?

The Benefits of Computer Forensics and Data Analysis

Planning Computer Forensics Engagement

Objective of a Computer Forensic Engagement

Legal Parameters

Execution of the Computer Forensic Engagement

Data Analysis Versus Data Mining

Plus more

Unit 12 - Cyber Security Tools & Techniques

This unit covers the following topics:

Prevention and Defenses

Authentication

Encryption

Digital Signatures

Steganography

Generating Secure Password

Tips For Buying Online

Wireless Security

Posting Personal Details

Plus More

Unit 13 - Developing Cyber Security policies

This unit covers the following topics:

Policies and training can limit the risk

Cyber Security Policy

Security Policy Elements

Policy Exceptions

Personnel and Training

Security Awareness and Training

Access Privileges

Plus More

Unit 14 - Developing a Cyber Security and Risk Mitigation Plan

This unit covers the following topics:

Establishing a Risk Management Framework

Cyber Asset Identification and Classification

Identifying Critical Cyber Assets

Classifying Cyber Assets

Assessing and Mitigating Risks

Plus More

Unit 15 - Forensic Team - working procedures

This unit covers the following topics:

Working in A Forensic Team

Teaming With Forensic Accounting Investigators

Internal Audit’s Position and Function

Objectives of All Interested Parties

Updated on 19 April, 2021

Eligibility / Requirements

Option 1

Forensic Accounting Advanced Diploma QLS Level 7 endorsed by Quality Licence Scheme

Certificate Fee: £170 + postal charges

Option 2

Forensic Accounting Advanced Diploma issued by OHSC

PDF Certificate - FREE

Hard copy - £25 + postal charges

Option 3

CPD Accredited Certificate

(PDF format)=£30

(Hard copy)=£150 + postal charges

*Postage Charges: National £9, International £15

Job roles this course is suitable for:

External Auditor , Financial Analyst , Financial Assurance Manager , Financial Assurance Specialist , Forensic Accountant , Information Technology Auditor , Internal Auditor , Senior Auditor , Senior Budget AnalystAbout Oxford Home Study College

Oxford Home Study Centre is the UK’s leading provider of affordable, accessible distance learning programs for students worldwide. We owe our international reputation to our founding principles of transparency, commitment to quality and unrivalled value for money.

Our course catalogue currently includes more than 100 fully-accredited online courses, covering the widest variety of subjects and specialisms. We are proud of our achievements in setting the high standard for distance learning .The quality of our courses and the support we offer to our students has resulted in tremendous success to the OHSC. We believe that the success of our college is underpinned by the success of our students. The students at OHSC get exceptional support from qualified and experienced tutors.

One of the main reasons for OHSC success is its uniquely individual, friendly and supportive service. We believe in quality; from our course materials to our tutor support and from our customer service to administration sector, students find fully committed team of professionals to deal with. We respond to 90% of emails with 24 hours. Learning Materials and Assessments are of high quality and are provided in easily accessible formats which can be viewed online or printed.

A certificate of completion (soft copy) can be claimed for £10. If you need a hard copy of this certificate you will pay £25 + postal charges ( £9 for UK students, £15 for outside UK)