- Duration / Course length: Upto 13 Hours Start now

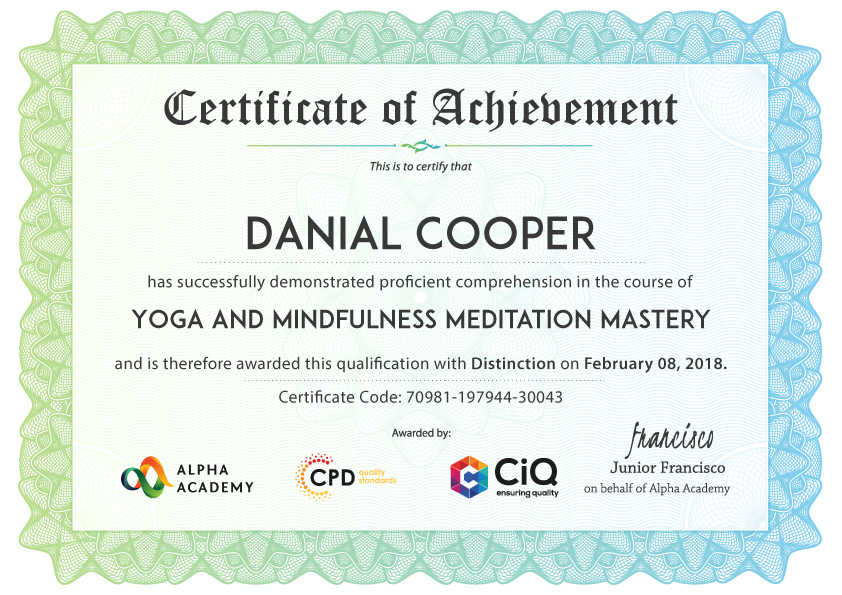

- Accredited by: CiQCPD Qualification Standards

- Certificates:

- Course delivery: This course is delivered in video format

Course details

If you are aspiring for a career in the financial industry or are currently working in this sector, this Certificate in Anti-Money Laundering Course is ideal for you. Beginner, mid and senior-level professionals or business owners will also benefit from this AML course. This course will teach you how to avoid falling victim to money laundering or fraud. You'll also learn how to minimise the risk of money laundering and ;This comprehensive Anti-Money Laundering Course will deepen your understanding of the complicated world of money laundering and how to keep your personal and company's data ; You will also learn the methods of money laundering, the economic and social consequences of money laundering, the process of money laundering, techniques to prevent terrorism financing and much more that will make you an certified anti-money laundering ;

After successful completion of this Anti- Money Laundering course you can safeguard the reputation of you or your organisation from money laundering. This Anti-Money Laundering Course comes with accredited certification from CPD which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ;

Learning Outcomes of anti money laundering course:

- Learn the definition of money laundering and understand the risks related to it

- Understand your responsibility within your organisation to curb money laundering

- Familiarise with the risk-based approach

- Understand what is suspicious activity and learn how to report it

- Familiarise with the economic and social consequences of money laundering

- Get a solid understanding of the various methods of money laundering

- Learn about bank complicity, non-bank financial institutions, insurance companies, and financial inclusion

- Understand the importance of record-keeping and learn about high currency amount transaction reporting

- Understand suspicious transaction reporting and learn how to prevent fraud in money transfers

- Explore the processes and methods of terrorism financing prevention

- The price is for the whole course including final exam - no hidden fees

- Accredited Certificate upon successful completion at an additional cost

- Efficient exam system with instant results

- Track progress within own personal learning portal

- 24/7 customer support via live chat

This valuable course is suitable for anyone interested in working in this sector or who simply wants to learn more about the topic. If you're an individual looking to excel within this field then Certificate in Anti-Money Laundering Course is for you.

We've taken this comprehensive course and broken it down into several manageable modules which we believe will assist you to easily grasp each concept - from the fundamental to the most advanced aspects of the course. It really is a sure pathway to success.

All our courses offer 12 months of access and are designed to be studied at your own pace so you can take as much or as little time as you need to complete and gain the full CPD accredited qualification. And, there are no hidden fees or exam charges.

We pride ourselves on having friendly and experienced instructors who provide full weekday support and are ready to help with any of your queries. So, if you need help, just drop them an email and await a speedy response.

Furthermore, you can check the validity of your qualification and verify your certification on our website at any time.

So, why not improve your chances of gaining professional skills and better earning potential.

COURSE CURRICULUM

- Anti-Money Laundering Online Course

- What is Money Laundering?

- More Definitions of Money Laundering

- How Money Laundering Works

- The Economic and Social Consequences of Money Laundering

- Methods of Money Laundering

- Payable Through Accounts

- Concentration Accounts

- Structuring

- Bank Complicity

- Non-Bank Financial Institutions

- Insurance Companies

- What is Financial Inclusion?

- Anti Money Laundering

- Record Keeping

- High Currency Amount Transaction Reporting

- Suspicious Transaction Reporting

- Fraud Prevention for Money Transfers

- Terrorism Financing Prevention

- Designation of a Compliance Officer

- Recommended Reading

- Mock Exam

- Final Exam

Eligibility / Requirements

- This course is available to all learners, of all academic backgrounds.

- Learners should be aged 16 or over to undertake the qualification.

- Good understanding of the English language, numeracy and ICT are required to attend this course.

Job roles this course is suitable for:

Forensic Audit Manager , Anti-Money Laundering Assistant , Antimoney Laundering SpecialistAbout Alpha Academy

Alpha Academy is an online learning platform that provides one of the best e-learning experience that you can think of. With a large variety of training courses to choose from, you are bound to find something to suit you. Whether it be to improve your current expertise or develop new skills, we can facilitate your goal. On top of our provision of professionally accredited courses, we also provide a free CV review for you within 24 hours of submission.

Why Choose Us:

- On top of our provision of professionally accredited courses, we also provide a free CV review for you within 24 hours of submission.

- This is perfect for you if you want to add the experience to your CV/Resumé or hang it on your wall.

Assessment and Certification

At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. After you have successfully passed the final exam, you will be able to order an Accredited Certificate of Achievement at an additional cost of £19 for a PDF copy and £29 for an original print copy sent to you by post or for both £39.