- Duration / Course length: Upto 3 Months Start now

- Accredited by: UKRLPACBS

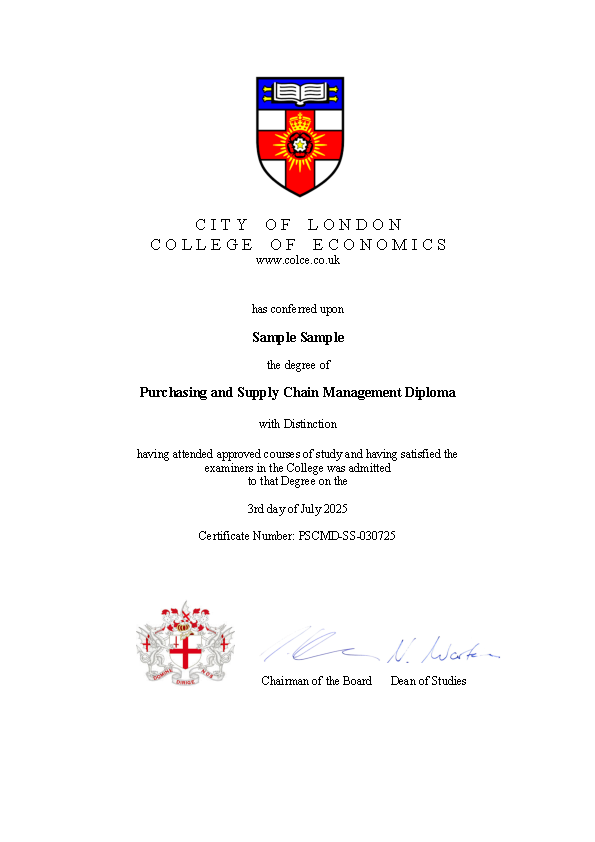

- Certificates:

- Course delivery: This course is delivered in presentation format

Course details

IFRS Expert DiplomaDuration: 3 months

Assessment: One comprehensive practical assignment

Become proficient in International Financial Reporting Standards (IFRS) with this globally recognized diploma designed to deepen your knowledge of IFRS principles, frameworks, and applications. This fully online, flexible program equips finance professionals and accountants with the skills to prepare, present, and interpret financial statements according to IFRS, enhancing your expertise in international accounting practices.

Course Modules and Key Learnings:

- IFRS Framework and Conceptual Framework for Financial Reporting

Understand the underlying principles governing IFRS, including objectives, qualitative characteristics of useful financial information, and the role of the IASB and IFRS Foundation. - Presentation of Financial Statements (IAS 1)

Master the structure and content requirements of balance sheets, income statements, statements of comprehensive income, and cash flows. - Accounting Policies, Changes in Accounting Estimates, and Errors (IAS 8)

Learn how to select and apply accounting policies, including disclosures related to changes and corrections. - Taxation (IAS 12 Income Taxes)

Explore recognition and measurement of current and deferred tax assets and liabilities, including temporary differences. - Financial Instruments (IFRS 9, IAS 32, IFRS 7)

Gain expertise in classification, measurement, impairment models, hedge accounting, and disclosures for financial instruments. - Earnings Per Share (IAS 33)

Understand the calculation, presentation, and disclosure requirements for basic and diluted earnings per share. - Other IFRS and IAS Standards Covered

Topics include revenue recognition (IFRS 15), leases (IFRS 16), property, plant and equipment (IAS 16), intangible assets (IAS 38), business combinations (IFRS 3), subsidiaries and associates (IFRS 10, IAS 28), provisions and contingencies (IAS 37), and foreign exchange effects (IAS 21). - Practical Application and Case Studies

Apply IFRS standards through self-test solutions, case studies, and real-world financial reporting scenarios to enhance comprehension and competence.

Your learning will be evaluated through one comprehensive practical assignment that emphasizes applying IFRS knowledge to realistic accounting and financial reporting situations. Students may start their assignment immediately upon enrollment and submit it flexibly to complete the diploma.

Updated on 31 July, 2025

About City of London College of Economics

City of London College of Economics (COLCE) is a recognized educational institution offering affordable, accredited online courses for vocational and academic growth. Our programs are self-paced for your convenience and designed with a practical focus, meeting high-quality and compliance standards (DSG, ISO 27001). We support learners worldwide in enhancing their career opportunities through comprehensive knowledge in economics, management, and related fields. COLCE is listed in the UK Government Register of Verified Learning Providers (Reference Number: 10089366) and accredited by the British Government, UKRLP, as well as the Association of Colleges and Business Schools (Certificate Serial Number: ACBS/COLCE/011525NF).