- Duration / Course length: Upto 6 Months Start now

- Accredited by: UKRLPACBS

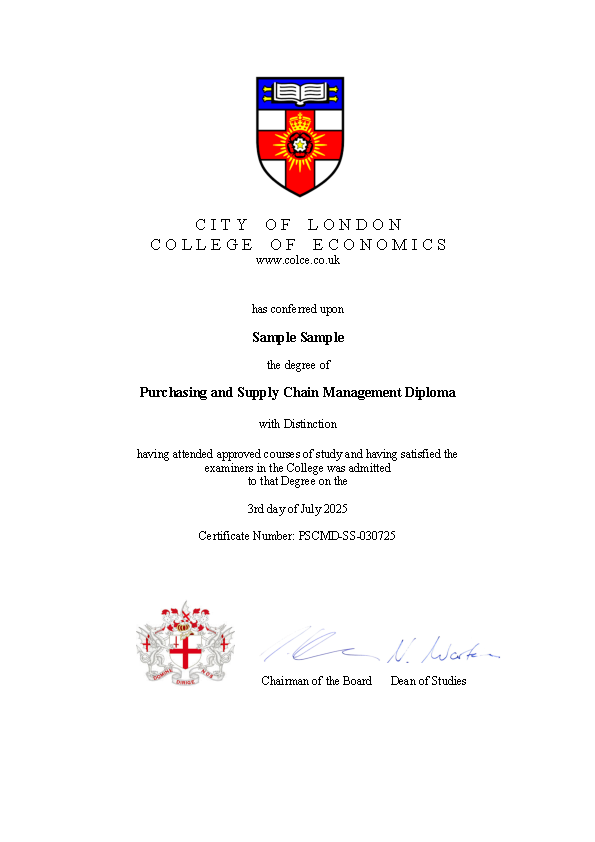

- Certificates:

- Course delivery: This course is delivered in presentation format

Course details

Fundamental Analyst DiplomaDuration: 6 months

Assessment: One comprehensive practical assignment

Develop essential skills to analyze companies deeply and make informed investment decisions with this internationally recognized diploma. This fully online, flexible program teaches you fundamental analysis principles—from basic concepts to advanced valuation and value investing techniques—preparing you to evaluate business financial health and market potential confidently.

Course Modules and Key Learnings:

- Introduction to Fundamental Analysis

Understand what fundamental analysis is, why it is used, and its importance in financial markets. - How to Perform Fundamental Analysis

Learn step-by-step processes to analyze financial statements, company performance, and broader economic factors. - Making Money from Fundamental Analysis

Explore practical applications of fundamental analysis to identify investment opportunities and generate returns. - Advanced Fundamental Analysis Techniques

Dive deeper into sophisticated tools, valuation models, and financial metrics to refine your analysis skills. - Examples and Case Studies of Fundamental Analysis

Study real-world examples demonstrating fundamental analysis methods applied to actual companies. - Key Factors to Look at When Analyzing a Company

Focus on vital indicators such as earnings, cash flow, management quality, market position, and competitive advantages. - Limitations of Fundamental Analysis

Understand what fundamental analysis cannot predict, including market sentiment, external shocks, and timing risks. - Value Investing Principles

Learn the philosophy and practical approach behind value investing—buying undervalued businesses for long-term growth. - Fundamentals for Fundamentalists

Identify traits of successful fundamental analysts and how to develop a disciplined investment mindset. - How to Buy and Evaluate a Business

Gain insights into assessing a business for purchase or investment, including due diligence and intrinsic value estimation. - Becoming a Value Investor

Develop strategies and habits that characterize successful value investors, including patience and risk management.

Demonstrate your mastery by completing one practical assignment that integrates theoretical knowledge with real-world fundamental analysis scenarios. You can start the assignment on day one and complete the diploma at your own pace, ensuring practical application of learned concepts.

Updated on 31 July, 2025

About City of London College of Economics

City of London College of Economics (COLCE) is a recognized educational institution offering affordable, accredited online courses for vocational and academic growth. Our programs are self-paced for your convenience and designed with a practical focus, meeting high-quality and compliance standards (DSG, ISO 27001). We support learners worldwide in enhancing their career opportunities through comprehensive knowledge in economics, management, and related fields. COLCE is listed in the UK Government Register of Verified Learning Providers (Reference Number: 10089366) and accredited by the British Government, UKRLP, as well as the Association of Colleges and Business Schools (Certificate Serial Number: ACBS/COLCE/011525NF).