- Duration / Course length: Upto 6 Months Start now

- Accredited by: UKRLPACBS

- Certificates:

- Course delivery: This course is delivered in presentation format

Course details

Diploma in Personal Financial PlanningDuration: 6 months

Assessment: One comprehensive practical assignment

Develop comprehensive expertise in personal financial planning with this fully online, flexible diploma designed to equip you with the knowledge and skills to manage your own finances or provide financial advice to others. Covering core elements of wealth management, budgeting, taxation, insurance, investments, and retirement planning, this course prepares you to create effective, personalized financial plans.

Course Modules and Key Learnings:

- Your Wealth Check

Assess your current financial status, assets, liabilities, and net worth to establish a baseline for planning. - Your Wealth Objectives

Define clear, realistic financial goals aligned with your life priorities and values. - Your Wealth Wisdom Plan

Learn how to design and implement a strategic financial plan that guides decision-making and progress toward goals. - Cultural Aspects of Personal Finance

Explore how cultural values and beliefs influence financial behavior, decision-making, and planning. - The Budget Process

Master techniques for creating, managing, and adjusting budgets that support financial discipline and goal achievement. - Income Expectations and Career Management

Understand income generation, career planning, and growth strategies to optimize your financial capacity. - Taxes

Gain knowledge of tax systems, obligations, deductions, and planning strategies to minimize tax liabilities legally. - Expenses Management

Learn to control expenses effectively, distinguish between needs and wants, and optimize cash flow. - Insurance

Study various insurance types (life, health, property) and how to use insurance products to protect financial wellbeing. - Mortgages and Property Finance

Understand mortgage options, lending processes, and strategies for property acquisition and management. - Credit Cards and Consumer Finance

Examine credit management principles, responsible borrowing, credit scoring, and debt reduction techniques. - Educational Finance

Plan for education costs, student loans, and investment in lifelong learning. - Mutual Funds and Investment Vehicles

Get introduced to mutual funds, stocks, bonds, and other investment products as tools for wealth accumulation. - Pensions and Retirement Planning

Learn about retirement savings options, pension schemes, and strategies to ensure financial security in later life. - Additional Topics

Coverage of estate planning, financial ethics, risk management, and adapting plans as life circumstances change.

Your practical ability to apply personal financial planning concepts will be evaluated through one assignment designed to simulate real-life financial planning scenarios. Students may start their assignments from day one and complete the diploma flexibly upon submission.

Updated on 31 July, 2025

Job roles this course is suitable for:

Personal Financial Planner , Personal Finance Advisor , Personal Finance ConsultantAbout City of London College of Economics

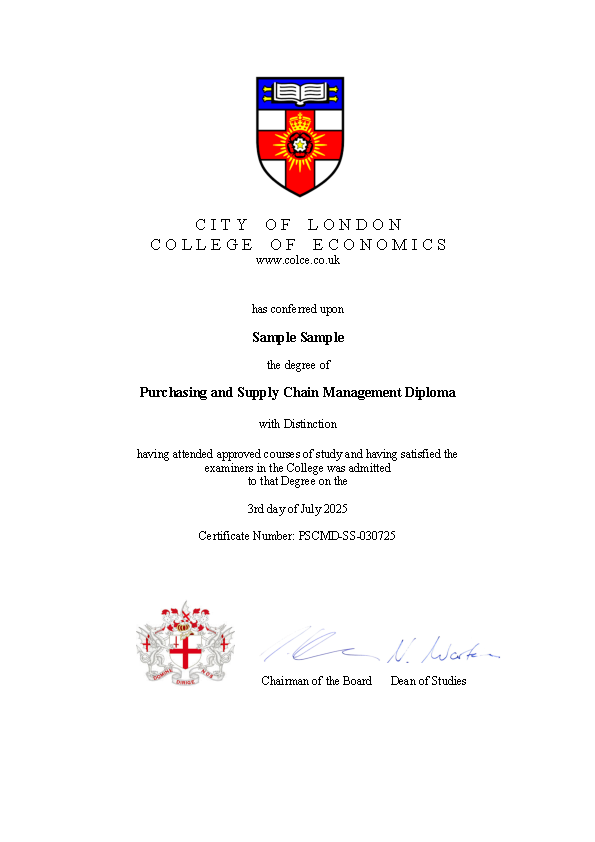

City of London College of Economics (COLCE) is a recognized educational institution offering affordable, accredited online courses for vocational and academic growth. Our programs are self-paced for your convenience and designed with a practical focus, meeting high-quality and compliance standards (DSG, ISO 27001). We support learners worldwide in enhancing their career opportunities through comprehensive knowledge in economics, management, and related fields. COLCE is listed in the UK Government Register of Verified Learning Providers (Reference Number: 10089366) and accredited by the British Government, UKRLP, as well as the Association of Colleges and Business Schools (Certificate Serial Number: ACBS/COLCE/011525NF).